Global Giant Set to Shake Up Australia’s Long-Stagnant Auto Salvage Market

For decades, Australia’s auto-salvage market—where insurers dispose of total-loss and damaged vehicles—has been mostly a two-horse race. Salvage auctions have always been part of the vehicle-remarketing landscape, but they’ve operated behind the scenes, quietly churning through thousands of collision write-offs, hailstorm casualties, flood damages and mechanical failures every year.

Now, one of the world’s most influential salvage specialists, Insurance Auto Auctions (IAA), as reported by Insurance Business has officially entered the Australian market—expectedly bringing with it global scale, sophisticated digital infrastructure, and the promise of genuine competition in a space that has barely moved in 20 years.

Industry observers say the arrival of a third major player could reshape the way insurers process total losses, how buyers access salvage inventory, and how quickly vehicles move from accident scene to auction block.

What Exactly Is the Auto Salvage Market?

The salvage market is the disposal engine of the insurance industry. When a vehicle is damaged beyond economical repair—or written off due to fire, flood, theft recovery or severe mechanical fault—it becomes “salvage.” Insurers then sell these cars to dismantlers, recyclers, repairers, exporters and hobbyists via auction platforms. It’s actually where I started in the auction market many decades ago by upcycling hidden gems from salvage auction lots.

From the perspective of insurers/disposers and buyers, the key pain points have historically included:

-

Slow assessments, often requiring physical inspections

-

Multiple vehicle movements between storage yards, repairers and auction sites

-

Limited buyer competition, mostly domestic

-

Inconsistent vehicle information, especially for online bidding

In a market where every day of storage, towing and administration increases insurer costs, efficiency and digital accuracy matter. But until now, Australia’s salvage infrastructure has been dominated by a small number of operators with mixed business models.

The Current Players: A Market Long Dominated by Two Giants

Pickles Auctions

Founded in 1964, Pickles is widely recognised as Australia’s leading salvage and industrial auction house. It sells everything from fleet vehicles to mining equipment—and, crucially, a massive share of the country’s total-loss insurance stock. Backed by private-equity firm Apax Partners since 2022, Pickles remains the largest domestic name in heavy salvage.

Manheim (Cox Automotive)

Manheim is the other heavyweight. With deep dealership relationships and large metropolitan auction centres, Manheim handles everything from retail cars to machinery and thousands of damaged vehicles each year. Its salvage division has long serviced major insurers.

Smaller Operators

Lloyd’s Auctioneers & Valuers, Autorola, and regional auction houses occasionally handle salvage inventory, but the scale and technology required to manage insurer volumes have kept the market effectively locked to Pickles and Manheim—until now.

IAA Arrives in Australia: A Specialist Built for Insurance Write-Offs

In 2025, IAA officially launched its Australian division, positioning itself not as a general auction house, but as a dedicated salvage-only alternative built around insurers’ needs.

The pitch is simple and pointed:

Better data, faster processing, global buyers, and higher salvage returns.

IAA’s Australian footprint already includes nine branches and over 70 storage yards, strategically located to minimise towing distances and reduce costs. The company is targeting a longstanding issue in Australia: the inefficient spider-web of tow-ins, storage stops, assessor visits and secondary transfers that plague the current total-loss process.

According to IAA APAC managing director Charles Cumming, the mission is to make salvage “one tow, one process,” supported by extensive digital integration with insurers’ claim platforms.

The launch could be a watershed moment for insurers who have long wanted:

-

faster salvage realisation

-

richer digital vehicle assessments

-

fewer claim-handling touchpoints

-

more competitive global auction participation

It also raises the bar for existing players, who may face pressure to expand digital assessment capabilities, improve reporting, or reduce fees now that global competition has arrived.

Who Is IAA? Inside the Salvage Powerhouse

Origins: A Small California Yard Becomes a Salvage Empire (1982–2000s)

IAA began in 1982 as Los Angeles Auto Salvage, founded by Bradley Scott. The company rapidly reinvented the salvage-auction model, went public, rebranded as Insurance Auto Auctions, and spent the 1990s expanding across the United States through aggressive acquisitions.

International Growth (2007–2020s)

-

2007: IAA entered Canada by acquiring Impact Auto Auctions, instantly gaining a national presence.

-

2010s: The company expanded into the UK and launched sophisticated digital auction platforms, uniting global buyers into a single marketplace.

-

2022: It entered the Asia-Pacific region via a partnership in Cambodia.

A New Era Under Ritchie Bros. (2023–present)

In 2023, Ritchie Bros.—the world’s largest industrial auction firm—acquired IAA, creating an integrated global marketplace spanning heavy equipment, salvage vehicles and remarketing services. With Ritchie’s resources, IAA accelerated its global expansion, culminating in the 2025 Australian launch.

IAA Today

-

200+ facilities across the U.S., Canada and UK

-

170+ countries represented in its buyer base

-

~4,500 employees worldwide

-

Headquarters near Chicago

-

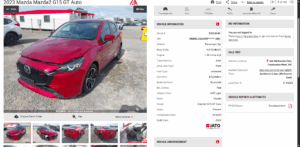

Industry-leading digital presentation tools: 360° imaging, engine-running videos, key audits, claims-system integration

At its core, IAA is a data-driven logistics and auction company specialising exclusively in total-loss and damaged vehicles—a focus that differentiates it sharply from traditional general-auction houses.

Why Australia? And Why Now?

The timing is no accident. The Australian salvage market is undergoing major pressure:

-

the assessor workforce is shrinking

-

hail and flood events are increasing claim volumes

-

insurers are prioritising digital transformation

-

premiums remain under scrutiny

-

transport and storage costs are rising

-

buyers want better online vehicle information

IAA believes its international model fits these pressures perfectly.

By combining global buyers (including right-hand-drive markets hungry for Toyota, Mazda, Ford and commercial vehicles) with a fully digital salvage pipeline, IAA argues it can boost returns for insurers while stabilising timelines for policyholders.

Expect the ripple effects to be significant:

-

Insurer leverage increases with a third major provider

-

Market competition heats up across fees, speed and technology

-

Existing auction houses face new expectations for integrated claims routing

-

Consolidation may accelerate as global players eye niche Australian segments

After decades of two-player equilibrium, the introduction of a tech-forward international specialist could transform both the economics and the customer experience of salvage in Australia.

Presently, IAA has locations established in Sydney, Newcastle, Melbourne (2), Adelaide, Gold Coast, Brisbane, and Townsville.

A Market Entering a New Phase

IAA’s move marks the most significant shift in Australia’s salvage industry in a generation. For insurers, it represents newfound choice. For auction incumbents, a direct challenge. For dismantlers, exporters and hobbyists, it promises a larger, more competitive, more globally connected marketplace.

And for the industry as a whole, it signals that Australian salvage is entering a modernisation cycle long overdue.